The CPA Advocate - Archived Articles 2016

December 2016

- AICPA Calls on IRS to Withdraw and Re-Propose Estate Valuation Discount Regulations

- AICPA Outlines Tax Reform Priorities

- AICPA Scores Tax Wins

- South Dakota CPA Lawmaker Named President-elect of NCSL

- SEC’s Chief Accountant Discusses IFRS and Revenue Recognition at AICPA Conference

- AICPA Offers Recommendations to Enhance Form 5500 Series Reporting for Employee Benefit Plans

- AICPA Panels React to FASB’s Targeted Improvements to Accounting for Hedging Activities

November 2016

- IRS Will Strive to Maintain Service Level in 2017, Commissioner Tells AICPA Tax Conference

- AICPA Chair Promotes Firm Mobility in NASBA Speech

- Connecticut Senator, CPA Society Call for Passage of Mobile Workforce Legislation

- Call for CPAs to Serve as AICPA Key Persons

- AICPA Sends Congress Recommended Legislative Changes to New Partnership Audit Regime

- AICPA Recommends Changes to IRS Revenue Procedure to Help Encourage Voluntary Compliance with Tax Accounting Methods

- AICPA Groups Comment on GASB’s Proposed Guidance on Certain Debt Extinguishments

- AICPA’s FinREC Comments on FASB’s Agenda Survey

October 2016

- Drones Emerge As a New Issue for CPA Firms

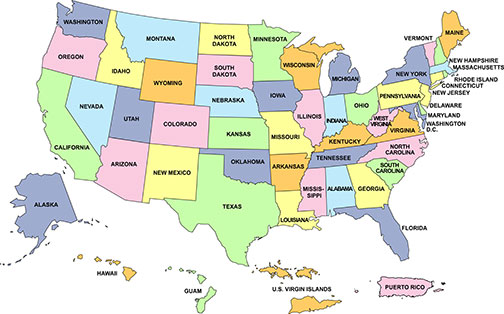

- Federal and State Election Results Could Impact CPA Profession

- North Carolina’s Supreme Court Rules in Favor of Accounting Firm in Case Involving Auditors’ Fiduciary Duties to Clients

- AICPA Lays Out Recommendations to IRS Regarding Guidance to Implement New Centralized Partnership Audit Regime

- AICPA Comments on Proposed Changes to FBAR Filing Requirements

- IRS Issues Estate Tax Guidance Requested by AICPA

- AICPA to IRS: Modify Proposed ITIN Application and Renewal Process

September 2016

- House Passes AICPA-Backed Mobile Workforce Bill

- AICPA and State CPA Societies Support Legislation to Ease Initial Shock of New Overtime Rule

- Provides Comments to Presidential Cybersecurity Commission; Issues Criteria for Evaluation of Businesses’ Cyber Risks

- AICPA Supports Presentation to Congress Regarding Federal Government's Audited Financial Statements

- AICPA Urges Congress to Modify Deadline for Reporting Estate Basis

- Free Washington Tax Brief Set for October 19

- AICPA Recommends Modifications to Domestic Manufacturing Deduction for Computer Software

- AICPA Weighs in on Proposed IRS Regulations Regarding Certified Professional Employer Organizations

August 2016

- Firm Mobility and Taxes on Professional Services Lead the CPA Profession’s State Priorities in 2017

- In Profile – Senator Michael Enzi (R-Wyo.)

- Panel Discusses Effects of Cyberattacks at Annual Conference for State Legislators

- AICPA Calls for End to Duplicative Expatriate Tax Reporting Requirements

- Charitable Contributions of Inventory Regulations Subject of AICPA Letter to IRS

- AICPA Recommends Guidelines to IRS for Tax-Exempt Organizations Reporting Unrelated Business Income

- FinREC Encourages FASB to Simplify Goodwill Impairment Test

- AICPA Groups Comment on GASB’s Proposed Lease Guidance

July 2016

- AICPA’s Melancon Sees Numerous Roles for CPAs in Battle against Cyber Crime

- Treasury Department Adopts AICPA Recommendations in Final Country-by-Country Reporting Rule

- Keep the Cash Method, AICPA’s Karl Writes in Blog

- AICPA to Treasury and IRS: Adopt Recommended Modifications and Delay Effective Date of Section 385 Proposed Regulations

- AICPA Webcast Helps Firms and Clients Understand and Prepare for DOL Overtime Rule Changes

- Minnesota CPA Society Meets with Congressional Delegation on Capitol Hill

- AICPA Comments on Proposed Expat Gift and Bequest Regulations

- AICPA’s Auditing Standards Board Provides Comments to IAASB on Enhancing Audit Quality

- AICPA Urges Changes to IRS Form 990 and Related Instructions

June 2016

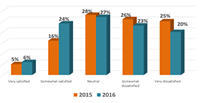

- IRS Service Survey Shows Slight Improvement; AICPA Advocacy Seeks to Boost Agency’s Effectiveness

- Congratulations to Delaware for Adopting Peer Review Requirement for CPA Firms

- AICPA Calls on Treasury to Extend Comment Period for Proposed Rules to Treat Certain Debt Instruments as Equity

- AICPA Urges IRS to Issue Additional Guidance on Virtual Currency Transactions

- Greater Flexibility for Definition of “Hospital” Needed Under ACA Rules, AICPA Tells IRS and Treasury

- Proposed Estate Tax Basis Reporting Regulations Subject of AICPA Comment Letter to IRS and Treasury

- AICPA Comments on Final Changes to the Single Audit Data Collection Form

- AICPA Sends Comments to IRS about Property Transfers to Partnerships with Related Foreign Partners

May 2016

- Timely and Meaningful Access to the IRS Is Most Important to Taxpayers and Tax Practitioners, AICPA Tells National Taxpayer Advocate

- AICPA Reacts to Department of Labor Overtime Rule, Encourages Action in Congress

- AICPA Urges Senators to Maintain Availability of Cash Method for Accounting Firms and Others

- CPA Profession Promotes Federal Fiscal Responsibility in Latest “What’s at Stake” Video

- AICPA Proposes Reduced User Fee for S Corporation Private Letter Ruling Requests

- Free Washington Tax Brief Set for June 22

- AICPA Offers IRS Recommendations on Agency’s 2016-2017 Guidance Priority List

- AICPA Recommends Form 990, Schedule L Changes to IRS

April 2016

- AICPA Urges Congress to Pass Mobile Workforce Bill at House Hearing

- Senate Finance Committee Approves Legislation Addressing Taxpayer Identity Theft; AICPA Seeks Focused Regulation of Tax Preparers

- AICPA Comments on EEOC Proposal to Include Additional Data on EEO-1 Form

- Taxes on Accounting Services an Emerging Issue in States

- AICPA Joins U.S. Senators to Promote Financial Literacy at Jump$tart’s Hill Day

- AICPA Groups Comment on Two Governmental Accounting Proposals

March 2016

- More States Looking to Adopt CPA Firm Mobility for Attest Services in 2016, 2017

- IRS Extends Estate Basis Consistency Deadline As Urged by AICPA

- AICPA Makes Recommendations to IRS on Proposed Country-by-Country Reporting Regulations for Multinational Enterprises

- AICPA Briefs Capitol Hill Staffers on Tax Season Changes and Challenges

- AICPA Presses U.S. Treasury to Adopt Recommendations to Ease Tax Burden on U.S. and Canadian Citizens Holding Certain Cross-Border Accounts

- AICPA Suggests Improvements to IRS's Offshore Voluntary Disclosure Program

- AICPA’s FinREC Encourages FASB to Develop Recognition and Measurement Guidance for Government Grants

February 2016

- Special Report: AICPA Tax Leaders Make Case for Improved IRS Service

- AICPA-Backed Proposals to Help Curb Tax ID Theft Discussed

- AICPA’s FinREC Comments on FASB Materiality Proposals

- Mobile Workforce Coalition Gears Up for Legislative Push

- AICPA Calls for More Guidance from IRS and Treasury on Estate Basis Reporting

- AICPA Groups Comment on GASB Proposal Addressing Pension Issues

- AICPA Comments on Key Single Audit Matters

January 2016

- AICPA Commends Congress for IRS Service Funding Hike

- In Profile – Rep. Collin Peterson (D-Minn.)

- State Legislative Proposals Related to Human Resources, Hiring Practices Could Have Negative Affect on CPA Firms

- CPAs and Congress – The 2016 Outlook

- Federal Budget Deficit on the Rise, Showing “What’s at Stake”

- AICPA Comments on New IRS Policy Regarding Estate Tax Closing Letters

For our most recent issue, visit The CPA Advocate home page.

For all previous articles, view the list above.