Firm Mobility and Taxes on Professional Services Lead the CPA Profession’s State Priorities in 2017

August 25, 2016

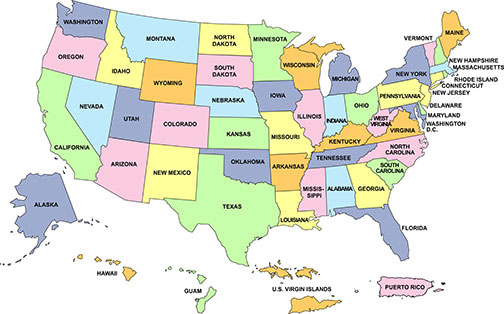

The American Institute of CPAs (AICPA) State Regulation and Legislation Team tracked over 500 bills affecting the CPA profession at the state-level in 2016. Several states adopted full CPA firm mobility, the comprehensive definition of attest, and new peer review requirements. States also saw an emerging tax on professional services threat that will carry into 2017.

CPA Firm Mobility

Because of the enormous success of individual mobility, state-level profession stakeholders are now looking to expand mobility laws to include CPA firm mobility. CPA firm mobility, also known as mobility for attest services, allows CPAs and CPA firms to offer attest services such as audits and reviews without having to get a reciprocal license. Louisiana and Washington signed legislation into law this year, bringing the total to 16 states with full CPA firm mobility. Illinois has pending firm mobility legislation that is expected to be considered in the next year.

Given the realities of today’s marketplace in which businesses and consumers operate across state lines, firm mobility will continue to be a key profession issue in 2017. CPA firm mobility gives the public more choices in services provided by CPA firms, allowing consumers to find a CPA that can best meet their needs.

Comprehensive Definition of Attest

Adopting the comprehensive definition of attest continues to be an important legislative topic. In 2014, the AICPA and the National Association of State Boards of Accountancy (NASBA) released a more comprehensive definition of attest in the Uniform Accountancy Act (UAA) that ensures important public protection for services performed under the AICPA’s Statements on Standards for Attestation Engagements to CPAs. The profession provides the public with a consistent standard of competence and regulatory oversight, whereas allowing non-CPAs to use AICPA standard reporting language risks misleading the public into believing they are bound by the same oversight and quality control as CPAs.

Kansas, Michigan, Mississippi, Nebraska, Rhode Island, Washington, and West Virginia all adopted the comprehensive definition of attest during 2016. The District of Columbia, Guam, and Pennsylvania still have pending legislation. Thirty-eight states now have the updated definition, with more expected to move toward adoption in 2017.

Taxes on Accounting Services

Many states are seeking new and additional revenue sources, resulting in several proposals to tax professional services, including those provided by CPAs and CPA firms. Legislatures in Arizona, California, Georgia, Oklahoma, and West Virginia introduced bills in 2016 that would create new taxes on professional services. While none of these bills have succeeded, the AICPA expects this to be a heavy focus for lawmakers in 2017, as the number of tax-related bills filed is generally higher in non-election years.

Hawaii, New Mexico, and South Dakota are the only states that currently impose a tax on accounting services. Accounting firms in Connecticut and Delaware face taxation on services such as data processing through a gross receipts tax.

Taxes on professional services cause a rise in compliance costs, leading to higher costs for consumers and small business owners. CPA firms regularly practice across state lines, meaning organizational and technical problems for administering a sales tax. Sales taxes can also cause businesses to take their accounting needs to firms outside the state, putting accounting firms in the state at a distinct disadvantage.

Peer Review

Five jurisdictions, Delaware, Hawaii, Indiana, Louisiana, and Tennessee, enacted bills related to peer review in 2016. Delaware now requires peer review for all Delaware CPA firms, thus moving the profession closer to its goal of enacting peer review requirements. The Hawaii bill revised various sections of the statute to permit persons licensed to practice public accountancy in any other state to perform peer reviews for firms that hold a Hawaii license. The bill also increased the deadline for filing the peer review compliance reporting forms and appealing certain peer review ratings from 10 days to 30 days. Indiana and Tennessee’s bills allow the boards of accountancy access to peer review documents. Both bills, as signed into law, will still require rulemaking to implement. The legislation in Louisiana clarified the requirement for firms providing attest services to be enrolled in a board-approved peer review program and approved certain permanent inspection processes of peer review programs.

Puerto Rico remains the only U.S. jurisdiction without a peer review requirement. Puerto Rico has pending peer review legislation that would eliminate the peer review membership requirement for CPAs performing certain agreed upon procedures required by the Treasury Department. The bill has been introduced before and has yet to move forward in the legislative process.

CPA Firm Ownership

The UAA, the model state legislation developed by the AICPA and the National Association of State Boards of Accountancy, allows for non-CPA ownership of firms by requiring that only a simple majority (50 percent+1) of the owners hold CPA licenses. Currently, 52 jurisdictions have the UAA simple majority provision in place. Delaware and New York introduced bills during 2016 to move to a simple majority of CPAs for firm ownership. While New York’s bill did not pass, Delaware’s was signed into law, leaving only three jurisdictions that do not allow for non-CPA ownership. Hawaii, New York, and the Northern Mariana Islands do not allow for non-CPA ownership.