Connecticut Senator, CPA Society Call for Passage of Mobile Workforce Legislation

November 21, 2016

U.S. Senator Richard Blumenthal (D-Conn.) recently joined Connecticut business and CPA profession leaders in calling for passage of legislation to simplify and standardize state income tax collection for employees who travel out of state.

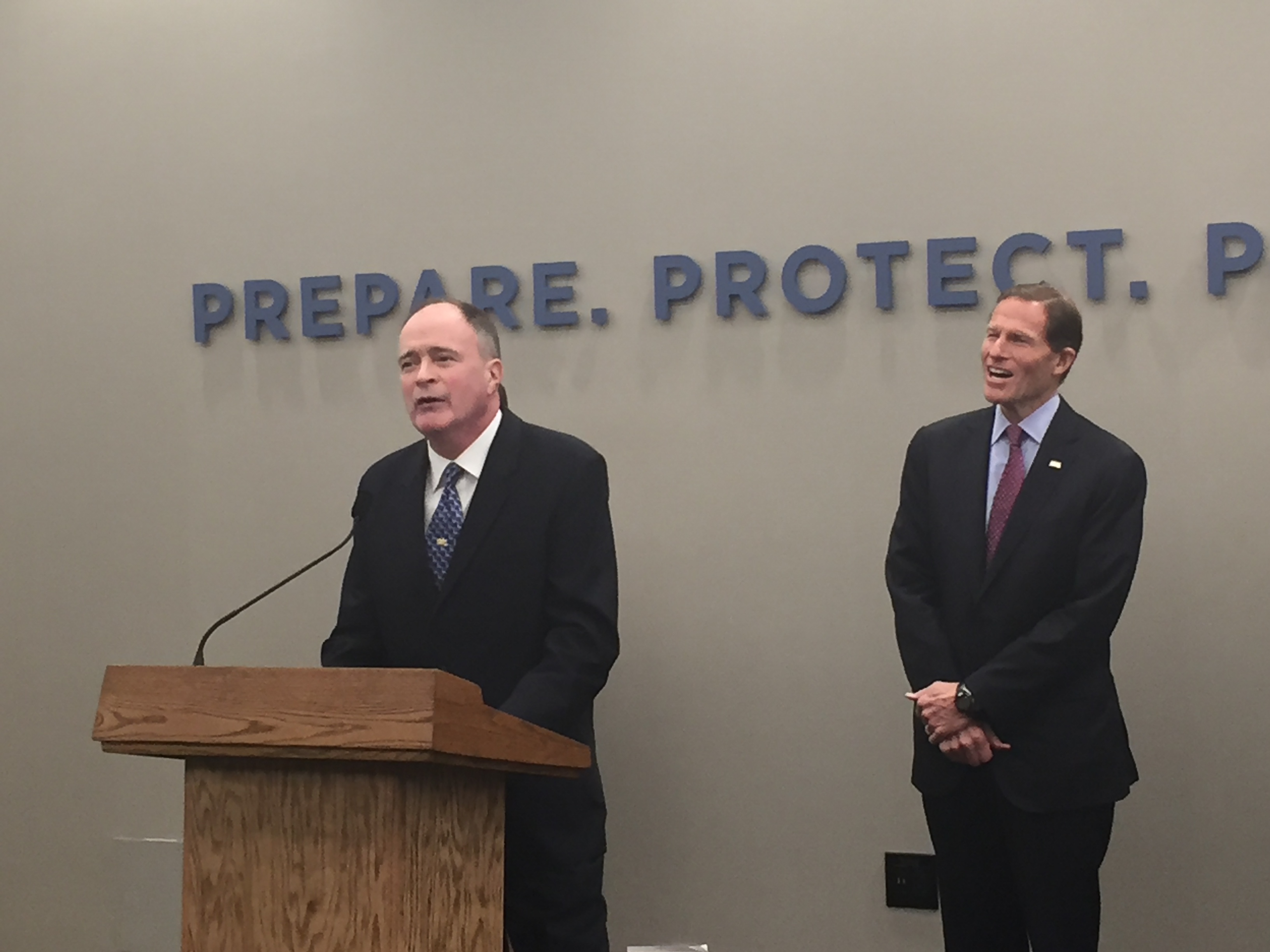

Blumenthal is among 51 Senate sponsors of the Mobile Workforce State Income Tax Simplification Act of 2015 (S. 386), bipartisan legislation that would bar states from taxing workers who spend less than 30 days performing duties in that state. At an event in Hartford, Connecticut on October 24, Blumenthal was joined by officials including Mark Zampino, public affairs director of the Connecticut Society of CPAs.

Connecticut-based employees are required to file income tax returns even if they spend just a few days performing duties in another state – an unfair system that penalizes workers and businesses, and threatens to stifle innovation and collaboration.

“We believe the 30-day threshold is fair, consistent, and predictable, and those are the three basic components of sound tax policy,” Zampino remarked, “so we thank Senator Blumenthal for his strong leadership on tax simplification.”

Stressing that travel is a vital part of our business economy – “something we should support, not stifle through arbitrary and conflicting state tax policies,” Blumenthal explained that “workers who meet with clients, vendors or colleagues out of state should not be required to file multiple state income tax returns – a waste of time and money better spent growing jobs and strengthening the local economy.”

Blumenthal and other backers of the mobile workforce legislation hope to schedule a Senate vote during the lame duck session of Congress that began November 14.