More States Looking to Adopt CPA Firm Mobility for Attest Services in 2016, 2017

March 30, 2016

Legislatures in Illinois, Louisiana, and Washington are considering bills that would allow out-of-state CPA firms to perform attest services for in-state clients without first having to register with the state board of accountancy or pay fees. The American Institute of CPAs’ (AICPA) State Regulation and Legislation Team is also working with other state CPA societies to get similar bills introduced in their legislatures in 2017.

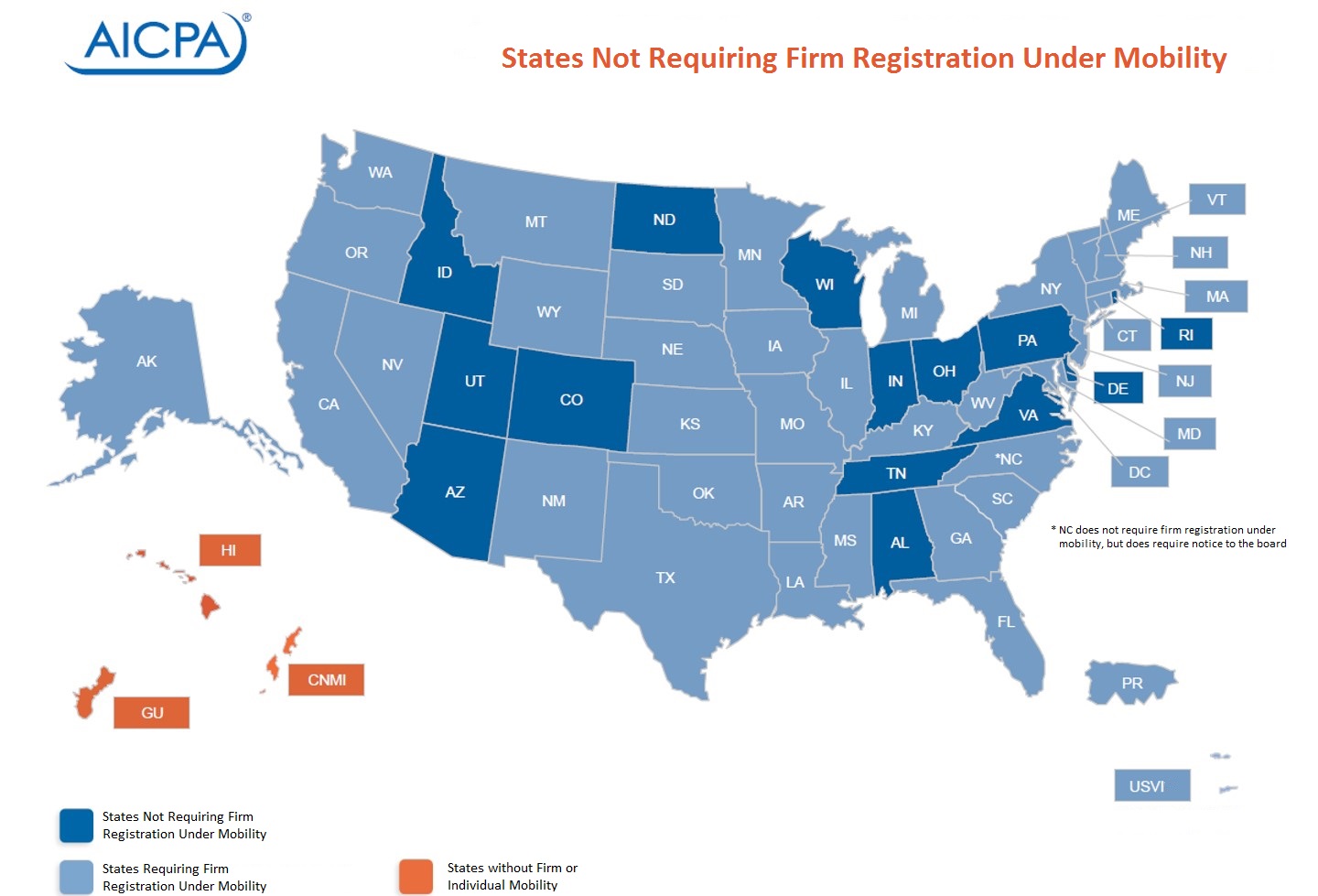

Fourteen states – almost one-third of the country – already allow for “CPA firm mobility.” In these states, firms operate under a “no notice, no fee, no escape” law. While out-of-state firms do not need to provide notice to a state board of accountancy to provide attest services, nor need to register as an out-of-state firm, they are still subject to that board’s rules, regulations, and requirements – including those related to firm ownership and peer review. Additionally, state boards of accountancy retain the same authority to investigate, fine, or even revoke a practice privilege. In this way, CPA firm mobility ensures strong regulatory protections for the public, while eliminating unnecessary compliance costs and fees.

“CPA firm mobility for attest services helps create a modern and effective regulatory regime for the accounting profession in the decades to come,” said Mat Young, AICPA vice president for state regulatory and legislative affairs. “It is about creating a level playing field across the states, ensuring public protection without unnecessary paperwork, and recognizing the ways in which CPAs and CPA firms operate in today’s business environment.”

The AICPA and the National Association of State Boards of Accountancy (NASBA) included CPA firm mobility in the seventh edition of their model state act, the Uniform Accountancy Act, which was released in May 2014. The provision is an extension of the popular individual mobility initiative that allows individual CPAs to provide non-attest services (such as tax advice, financial planning, and consulting services) in 52 states and jurisdictions without having to obtain a reciprocal license.

For more information on CPA firm mobility and other policy trends, visit the State Regulation and Legislation Team website and follow the team on Twitter @AICPAState.