IRS Service Survey Shows Slight Improvement; AICPA Advocacy Seeks to Boost Agency’s Effectiveness

June 23, 2016

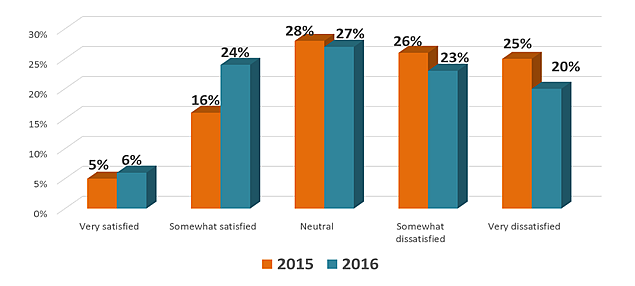

An American Institute of CPAs’ (AICPA) member survey conducted in April revealed that the long wait times to reach an IRS representative have shortened somewhat compared with 2015 experiences, but the quality of the responses are still lacking.

“We know that a year ago the wait times were horrendous and very frustrating for CPAs,” said Edward S. Karl, CPA, CGMA, the AICPA’s vice president for taxation. “It seems as if the wait times improved this year, but the quality of IRS responses, speaking to someone who understands your issue, remains a problem.”

Member Satisfaction with IRS Service 2015-2016

Asked what change would have the greatest impact on their practice, more than a third of respondents (36 percent) said it’s “efficiency in responding to written communications.” The finding came as no surprise to Karl, who explained that “CPAs use written communications in their practices as an efficient way to resolve client issues.”

The IRS continues to take steps to protect taxpayers and help victims of identity theft, including using filters (such as change of address or change of bank account) to identify bogus returns. But that activity has slowed the refund process for some taxpayers, with some practitioners reporting that clients are still awaiting their refunds from 2014 returns.

The AICPA’s governing Council in 2015 adopted a resolution that attempted to bridge the gap between unacceptably low service levels and the desire to transform the IRS into a modern functioning, evolutionary, and respected federal agency for the 21st century. Not surprisingly, the member survey found that more than two-thirds (68 percent) believe the IRS is not on the right track to become a modern-functioning agency. “An objective, transparent process is needed to change the IRS,” said Karl, “and our members want the AICPA to play a leading role in helping drive the aim of the resolution.”

There are two major approaches that the AICPA’s advocacy is taking in this area. First, as the IRS moves ahead with its “Future State” initiative – a strategic effort whose goal is helping the agency improve its performance in a resource-constrained environment – Karl says it is important that the reality of CPA tax practitioners’ experience be represented in the dialogue. “Our members are on the front lines representing taxpayers and we want to share their experiences and expertise with the IRS and others,” he explained. The other aspect is continuation of the resolution-related objective, transparent discussion that began during a “fly-in” of AICPA members in February to meet with Congressional representatives and the IRS Commissioner. “We want to engage Congress and the IRS in a continuing discussion about how we get the IRS to a respected status overall,” Karl said.

Asked what change would have the greatest impact on their practice, more than a third of respondents (36 percent) said it’s “efficiency in responding to written communications.” The finding came as no surprise to Karl, who explained that “CPAs use written communications in their practices as an efficient way to resolve client issues.”

The IRS continues to take steps to protect taxpayers and help victims of identity theft, including using filters (such as change of address or change of bank account) to identify bogus returns. But that activity has slowed the refund process for some taxpayers, with some practitioners reporting that clients are still awaiting their refunds from 2014 returns.

The AICPA’s governing Council in 2015 adopted a resolution that attempted to bridge the gap between unacceptably low service levels and the desire to transform the IRS into a modern functioning, evolutionary, and respected federal agency for the 21st century. Not surprisingly, the member survey found that more than two-thirds (68 percent) believe the IRS is not on the right track to become a modern-functioning agency. “An objective, transparent process is needed to change the IRS,” said Karl, “and our members want the AICPA to play a leading role in helping drive the aim of the resolution.”

There are two major approaches that the AICPA’s advocacy is taking in this area. First, as the IRS moves ahead with its “Future State” initiative – a strategic effort whose goal is helping the agency improve its performance in a resource-constrained environment – Karl says it is important that the reality of CPA tax practitioners’ experience be represented in the dialogue. “Our members are on the front lines representing taxpayers and we want to share their experiences and expertise with the IRS and others,” he explained. The other aspect is continuation of the resolution-related objective, transparent discussion that began during a “fly-in” of AICPA members in February to meet with Congressional representatives and the IRS Commissioner. “We want to engage Congress and the IRS in a continuing discussion about how we get the IRS to a respected status overall,” Karl said.