AICPA 401(k) Plans for Firms Overview

Your Firm Will Enjoy a Long List of Plan Benefits

The AICPA 401(k) Plans for Firms program offers a comprehensive, affordable, and easy to manage program. Take a moment to consider all the plan includes:

*Offered through a third party, additional fees may apply.

Why a 401(k) is the Smart Choice for EVERYONE

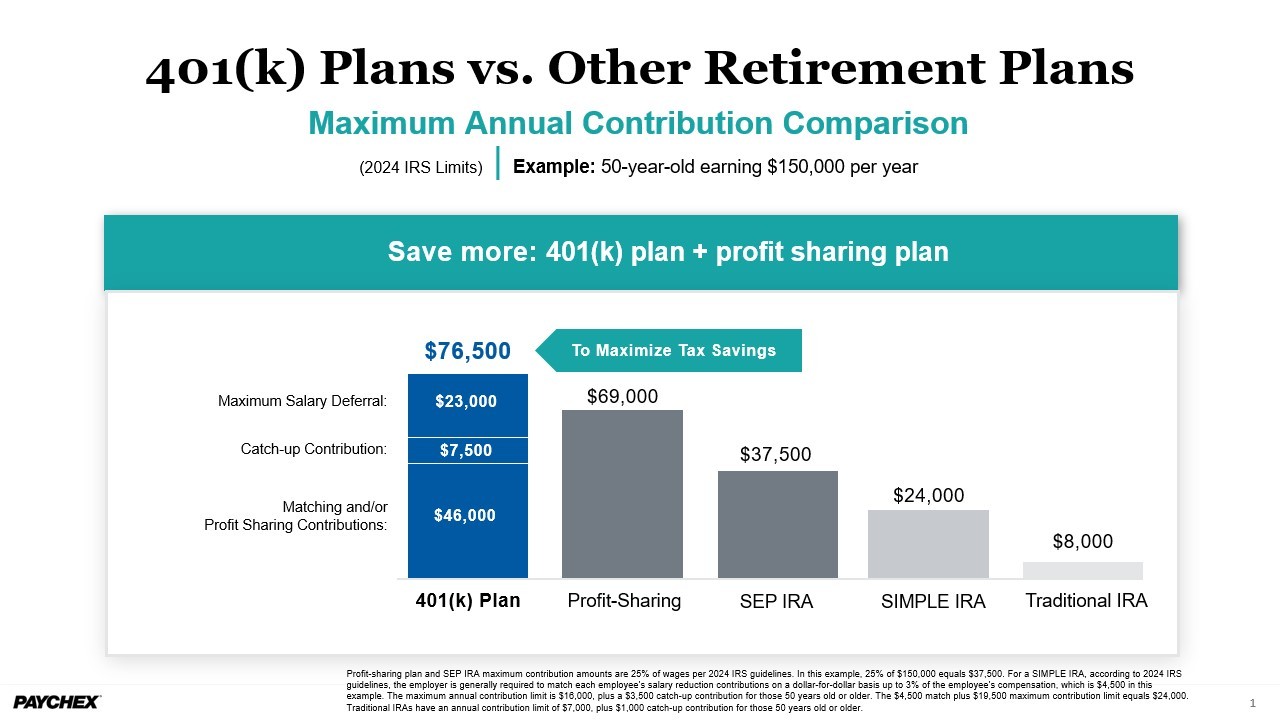

A 401(k) plan represents one of the most sound retirement options—with the ability to contribute more throughout the year than other plans. Consider the following example:

More Reasons Why 401(k) Makes Sense: Why a 401(k) is the Smart Choice for EVERYONE

- Up to a $500 annual tax credit for 3 years for qualifying firms for establishing a plan

- Profit Share component can be built in with options to maximize employer amounts

- Low cost investment options to help to keep more of your savings

- Emergency access via loans (optional)

- Customized Choice of vesting schedules and eligibility options to address your firm's specific objectives

- Allows both pretax and post-tax (ROTH) contributions, regardless of income

- Protected from creditors in every state

For more information about the program:

- Read the AICPA 401(k) Plans for Firms program overview

- Call 877.264.2615 to speak to a Retirement specialist

(Monday- Friday 8:00a.m.-8:00p.m. ET) - Complete this Online Form, and a Retirement specialist will contact you