Invigorate the Focus on Quality Toolkit

Join the PCPS Firm Practice Management Section today!

For the past several years audit quality has surfaced as a focus for both public and private companies. The AICPA is working to bring solutions to the auditing challenges for private companies, including not-for-profit organizations, employee benefit plans and governmental entities.

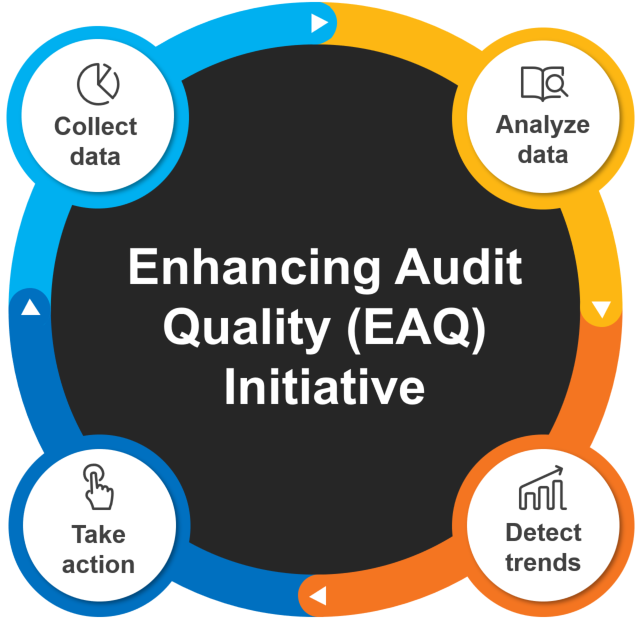

The AICPA’s Enhancing Audit Quality (EAQ) initiative addresses quality challenges on a holistic, ongoing basis with the goal of improving audit performance. This toolkit, which is one component of the EAQ initiative, contains resources to help invigorate the focus on quality in your practice

Navigate the Toolkit Resources

![]() Tone at the Top - Your Starting Point for Quality - Start Here and use this document to guide you through the rest of the toolkit.

Tone at the Top - Your Starting Point for Quality - Start Here and use this document to guide you through the rest of the toolkit.

![]() Client Evaluation Tools - To increase quality, reduce engagement risk and improve profitability, make sure you are working with the right clients.

Client Evaluation Tools - To increase quality, reduce engagement risk and improve profitability, make sure you are working with the right clients.

![]() Proposal and Profitability Tools- Show your commitment to quality to prospective clients and help them in choosing a quality auditor.

Proposal and Profitability Tools- Show your commitment to quality to prospective clients and help them in choosing a quality auditor.

![]() Quality Control & Peer Review – Review your quality control system and get the most from your peer review.

Quality Control & Peer Review – Review your quality control system and get the most from your peer review.

![]() Additional Resources – Consider additional suggested resources to maintain your firm’s competence in ever-evolving environments.

Additional Resources – Consider additional suggested resources to maintain your firm’s competence in ever-evolving environments.

NEW! Download all of the toolkit resources in one zip file. Once you’ve downloaded all the resources, start with the Tone at the Top Action Plan as a guide to the toolkit resources.

Tone at the Top - Your Starting Point for Quality

- Tone at the Top Action Plan - Start Here and use this document to guide you through the rest of the toolkit.

- Professionals Training PowerPoint Template - A key component to reinforcing your firm’s commitment to quality is staff training on your QC policies and procedures. Use this template to communicate those policies and to review common trouble spots areas of focus in peer reviews.

Client Evaluation Tools

- Continuing Client Evaluation Tool – Consider continuing client relationships based on several criteria since working with clients that are a right fit for the firm can improve profitability and audit quality.

- Prospective Client Evaluation Tool – Before beginning a client relationship, consider factors that can help you determine whether your firm can provide high quality and profitable services.

Learn from other practitioners how they evaluate clients before accepting them and how it benefits their firm

Proposal and Profitability Tools

- Proposal Meeting Prep Checklist - Review this checklist before your proposal meeting to help ensure you’re prepared for successful discussions with your potential clients

- Overcoming Pricing Objections Tool – Take a look at some common client pricing objections and the related considerations and talking points when responding.

- Client Brochure – Choosing a Quality Auditor (co-brandable) - Post this resource on your website to help potential clients explore the proposal process, with a focus on choosing a firm that emphasizes quality services. Consider customizing this brochure with your firm’s information prior to distribution. The co-brandable resource has been formatted to print as a document, booklet or brochure to help you engage your target audience.

- Proposal Template Wording - Create or enhance your proposals with elements that articulate your firm’s commitment to quality work and the unique experience and expertise you and your team members offer.

- Proposal Evaluation Matrix (for clients to use) - Provide this tool to potential clients to assist them in evaluating proposals from CPA firms. This tool reminds clients that low cost should not overshadow value and audit quality. If you have used the Proposal Template Wording, you will have an edge!

Quality Control & Peer Review

- AICPA Audit and Accounting Practice Aid – Take advantage of this practice aid to help develop the policies and procedures for your firm’s system of quality control. This revised Practice Aid is more easily customizable and includes enhanced guidance.

- Use these questionnaires, which are utilized by peer reviewers, to think about the design of your quality control system and your firm’s compliance with that system. Please visit the Peer Review Program Manual (PRPM) web page to download the latest version of the “Team and Review Captain Packages Available to AICPA members” zip file to access the questionnaires. The questionnaires are available in the Team Captain Package (Materials for System Reviews) folder of the zip file.

- Guidelines for Review of Quality Control Policies and Procedures for a Sole Practitioner with No Personnel (4,500)

- Guidelines for Testing Compliance with Quality Control Policies and Procedures for a Sole Practitioner with No Personnel (4,550)

- Guidelines for Review of Quality Control Policies and Procedures for Firms with Two or More Personnel (4,600)

- Guidelines for Testing Compliance with Quality Control Policies and Procedures for Firms with Two of More Personnel (4,650)

- Avoid Potholes for a Smooth Ride to Peer Review Guide - Use the experiences of others to map your route to a smooth peer review.

- Practice Aid – Establishing and Maintaining a System of Quality Control - Utilize this free practice aid in developing your quality control documents. Chapter 2 provides guidance on policies and procedures.

- Find a Peer Reviewer

- Selecting a Quality Peer Reviewer - Get advice for finding a quality peer reviewer to make the most of your peer review.

- How to get the most out of your peer review - Consider some ideas on adding even more value to your peer reviewer relationship.

- NEW! Audit Documentation Resources – Peer reviewers will be increasing their emphasis on the most common cause of material non-conformity, lack of documentation. Help prepare your firm with these helpful tools.

Additional Resources

Forming Alliances with Other Firms - Develop a network of peers to help ensure your ability to deliver quality servicesCPA Firm A&A Resources

Center for Plain English Accounting - Through reports, alerts, webinars, and written answers to written questions, the CPEA’s straight-forward and clear style of A&A guidance provides support by describing “how to do” what you “need to do” in implementing the authoritative literature.

Center for Audit Quality Center - The CAQ serves as a resource for member firms, supporting their public company audit practices, offering useful information and a vital forum for addressing issues affecting the profession.

AICPA Competency Framework - This free resource supports the Enhancing Audit Quality (EAQ) Initiative. The framework is designed to help CPAs understand the knowledge and skills necessary to perform high-quality audit, attestation, review compilation and preparation engagements.

Employee Benefit Plan Audit Quality Center - To help CPAs meet the challenges of performing quality audits in this unique and complex area, the AICPA has established the EBPAQC, a firm-based voluntary membership center for firms that audit employee benefit plans.

Employee Benefit Plan Audit Learning Resources - Employee benefit plan audit learning resources are now available on the AICPA | CIMA Competency and Learning website, featuring new knowledge checks.

Governmental Audit Quality Center - The Center serves as a comprehensive resource for member firms and state audit organizations, supporting you on your governmental audits.

Mandatory Firm Rotation - Keep up to date with new developments on Mandatory Firm Rotation (MFR) by checking out these resources with the most recent news stories from the U.S. and around the world.

Specialized Certificate Programs – Showcase your commitment to competency in complex and specialized industries by obtaining digital badges to promote your knowledge. Programs are currently available for employee benefit plans and single audits.