The NC Dental Board Decision: Impact on the Profession and Recommendations for State CPA Society Action

Background

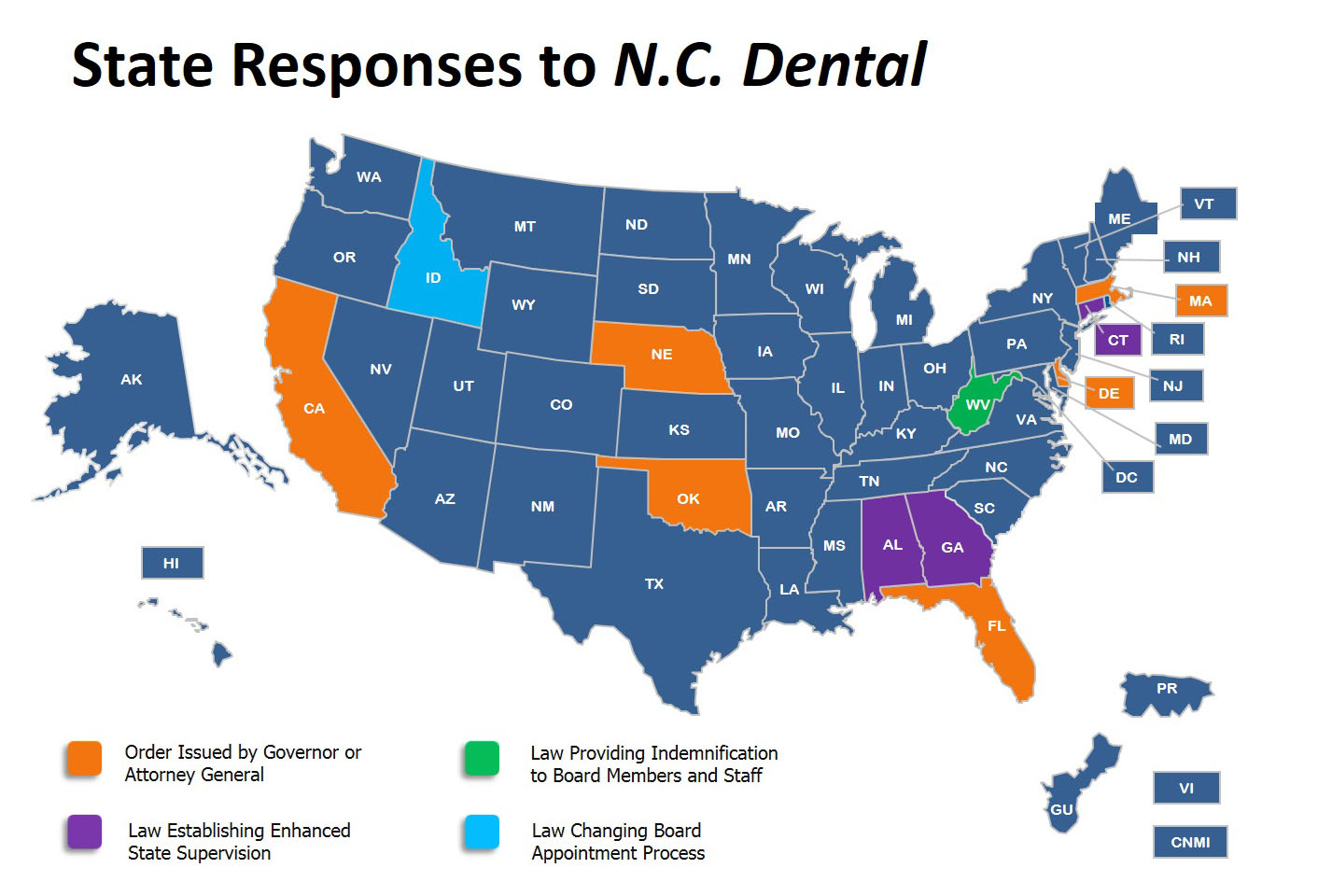

In February 2015, the U.S. Supreme Court issued a 6-3 ruling in North Carolina State Board of Dental Examiners v. F.T.C. (NC Dental) effectively limiting the conditions under which members of a state regulatory board with “market participants” – such as accountancy boards – may claim immunity from antitrust laws.

While the details of the case are particular to dentists, the ramifications apply equally to many state regulatory boards, and puts state boards of accountancy members at risk of being personally sued for the actions they take as board members. This presents a problem not only for individual board members, but for the profession as a whole, as fewer qualified CPAs may wish to serve on their state boards.

Recommended State Action: State-Level Immunity and Indemnification

The AICPA recommends that state CPA societies consider supporting immunity (exempting individuals from lawsuits for certain actions) and indemnification (offering to cover legal costs for lawsuits) legislation for boards of accountancy and their members.

Since board members are volunteering their professional insights and judgment, states should be willing to make clear that members are not subject to personal liability as a result of their service on the board. The state should also indemnify boards and members for actions taken in their official capacities. Indemnification provides assurance to current and potential board members that they will not bear the costs of potential antitrust liability, and fosters the likelihood of continued interest in service on state boards, providing the state with the expertise required to regulate licensed professionals.

The Uniform Accountancy Act (UAA) already contains a model immunity and indemnification provision in Section 4(g)(2).

Key Provisions in Immunity and Indemnification Legislation

The AICPA recommends that statutes providing board members immunity and indemnification incorporate these five elements:

- Specifically include professional boards, their members (consider including former board members), and board agents (which would likely include board employees);

- Provide that board members and board agents may not be subject to liability in their personal or official capacities as a result of their service on the board;

- Provide indemnification for claims arising from, or relating to, board members’ and agents’ actions or omissions while acting pursuant to their official responsibilities;

- Cover costs and attorneys’ fees, including advancement of legal fees or a provision for the state to undertake the individual’s defense directly, to make clear the statute covers the costs of defense and not simply payment of adverse judgments; and

- Make immunity and indemnification automatic, not a matter within the attorney general or another state actor’s discretion.

Sample Model Language

- Any member or agent of a state professional or occupational board, including any former member or agent, is immune from liability in his or her personal or official capacity for any action taken or omission in the discharge of the board’s responsibilities.

- The state shall indemnify the board and those members and agents for, and hold them harmless from, any and all costs, damages, and reasonable attorneys’ fees arising from, or related in any way to, claims or actions against them as to matters to which the immunity applies. The state shall undertake a member or agent’s defense, or advance legal fees to the member or agent.

Additional Considerations

For a more in-depth look at each of the key issues and potential solutions, refer to the August 2016 memo sent to state CPA societies.

Related Resources

- California Attorney General Opinion No. 15-402

- Delaware Executive Order No. 60

- Florida Attorney General Letter to Legislature

- Florida Attorney General PowerPoint Presentation to State Regulatory Boards

- FTC’s Final Order Regarding NC Dental Board

- FTC Staff Guidance on Active State Supervision of State Regulatory Boards Controlled by Market Participants

- Massachusetts Executive Order No. 567: To Ensure Proper Review of the Regulation of Professional Licensing by Independent Boards

- NASBA Resources Related to N.C. Dental Decision

- Oklahoma Executive Order 2015-33

- White House Report - Occupational Licensing: A Framework for Policymakers