Providing Services to Businesses in the Marijuana Industry

Overview

Background

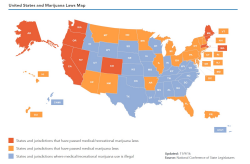

States across the country now allow marijuana to be sold for medicinal – and, in four states, recreational – purposes. As a result, new businesses in this industry are seeking the services of CPAs. However, marijuana is still classified as a Schedule 1 controlled substance under the federal Controlled Substances Act of 1970 and is subject to federal prosecution. As such, CPAs are looking to their state boards of accountancy to determine if providing services to businesses in the marijuana industry is permissible.

News & Updates

- Advocacy team celebrates legislative victory, Washington Society of CPAs, March 2018

- Justice Department cracks down on legal marijuana with rollback of Obama policy, USA Today, January 4, 2018

- CPAs with Clients in the Marijuana Industry Need to Consider Risks, AICPA Insights, October 2016

- Marijuana Business and Sec. 280E: Potential Pitfalls for Clients and Advisers, The Tax Advisor, July 2015

- Measuring the taxable income of a marijuana business, Tax Insider, February 2015

- Taxpayers Trafficking in a Schedule I or Schedule II Controlled Substance -- Capitalization of Inventoriable Costs, IRS Memorandum, December 2014

Related Resources

- Current State Board Positions – As of January 2018, twelve state boards (Arizona, Arkansas, Colorado, Connecticut, Florida, Maryland, Massachusetts, Michigan, New Mexico, Nevada, Oregon and Washington) have issued official guidance for licensees in their state who wish to offer services to businesses in the marijuana industry.

- Key Policy Suggestions – These suggestions, based upon existing policies, can help guide discussions with state boards of accountancy that are developing guidance for their licensees.

- An Issue Brief on State Marijuana Laws and the CPA Profession – This white paper provides licensees with an overview of U.S. recreational and medicinal marijuana laws, relevant sections of the AICPA Code of Professional Conduct, and the current legislative/regulatory environment, as well as key issues to consider when deciding whether to provide services to businesses that operate in the marijuana industry.

- Understanding the Impact of Legalized Marijuana on the CPA Profession – The webcast features panelists from the AICPA State Regulatory and Legislative Affairs, Audit and Attest Standards, Professional Ethics, and Tax Division teams, as well as Aon Insurance Services.