Attest, Firm Mobility Among Top Profession Trends in State Legislatures

March 10, 2017

With the 2017 legislative sessions well underway, states are seeing multiple trends impacting the CPA profession, including the comprehensive definition of attest, CPA firm mobility, taxation of professional services, and human resource issues.

Comprehensive Definition of Attest

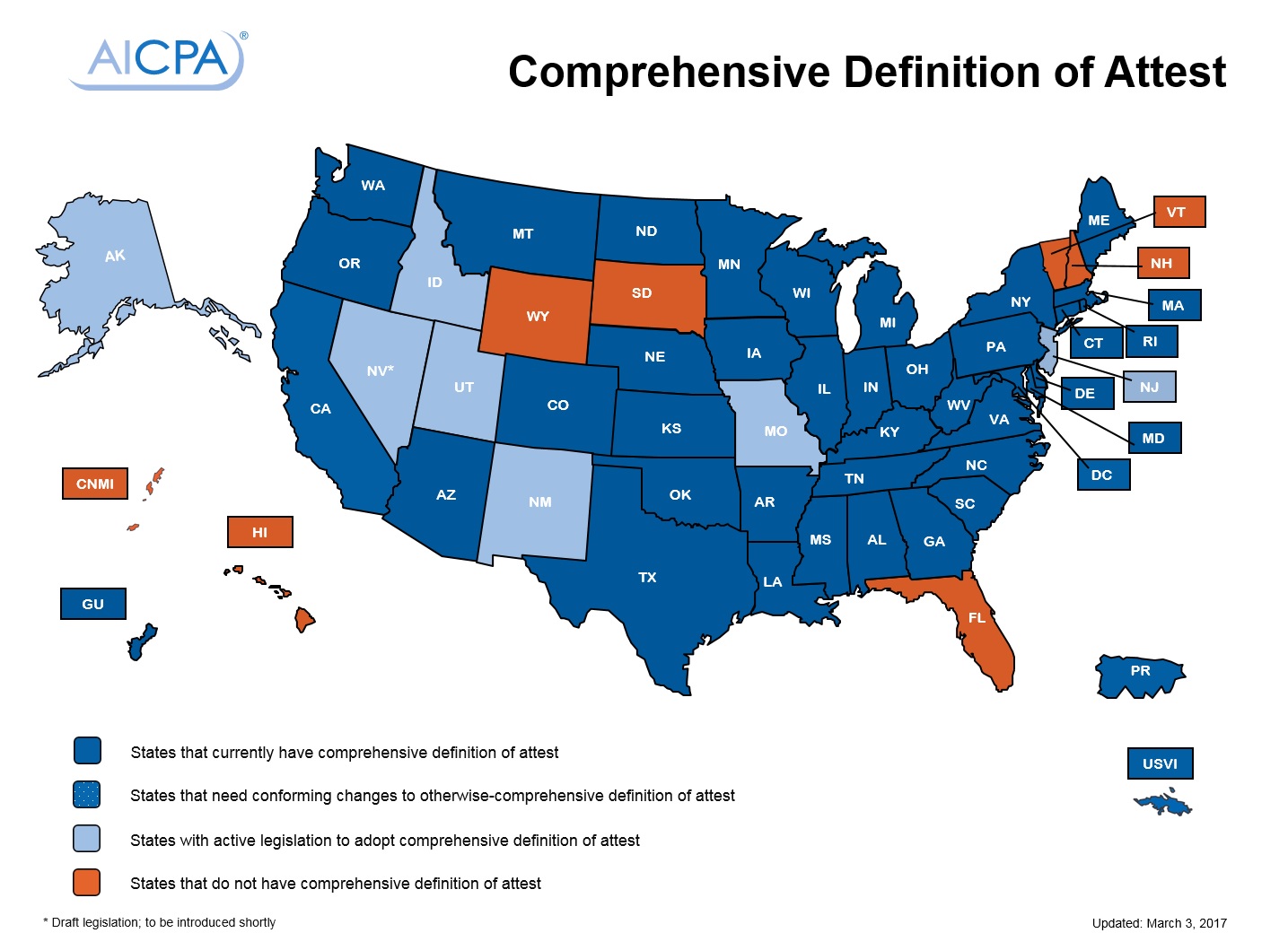

Arkansas and the District of Columbia recently became the first states in 2017 to adopt the comprehensive definition of attest. In total, 41 states now have the comprehensive definition in their laws.

Additionally, six other states – Alaska, Idaho, Missouri, New Jersey, New Mexico, and Utah – have pending legislation. Idaho, New Mexico, and Utah’s legislation recently passed their first house.

The demand for attest services has changed significantly, expanding to engagements such as security and privacy controls and sustainability. Others in the marketplace are offering these services while using the CPA profession’s standards, but without the same credentials, experience, or regulation. Adoption of the comprehensive definition of attest ensures that only CPAs operating in a CPA firm can provide attest services under the profession’s standards.

CPA Firm Mobility

Eight states – Iowa, Illinois, Massachusetts, Missouri, Montana, Nevada, New Jersey, and New Mexico – have introduced legislation to allow CPA firms from outside the state to perform attest services without registering their firms in the state. Montana and New Mexico’s bills recently passed their first house. Currently, 16 states provide for full CPA firm mobility.

Taxation of Professional Services

Several states have introduced legislation to impose taxes on professional services. Some states, such as Indiana, are creating interim study committees to examine expanding the sales tax base. Others, such as Nebraska and Utah, have introduced bills to directly tax professional services, including tax preparation and payroll services. Nine states have introduced tax on professional services legislation so far in 2017.

Human Resources

Thus far in 2017, 40 states have introduced legislation related to human resources, such as expungement, pay equity, universal paid leave, and pre-employment inquiries such as ban the box. The District of Columbia, Hawaii, Missouri, and Oklahoma introduced legislation to mandate paid leave for employees administered through a government run fund. Several states, such as California, Idaho, Maryland, Oklahoma, and Washington, also have pending legislation prohibiting employers from inquiring into a job applicant’s salary history.