Maryland eases regulatory burden on out-of-state CPA firms

May 30, 2019

CPA firms around the country can now operate in Maryland without paying a fee or notifying the Maryland Board of Public Accountancy. Maryland Governor Larry Hogan (R) signed a legislation into law on April 30 that allows out-of-state CPA firms to offer attest services without notice, fee or escape.

CPA firm mobility means CPA firms can offer services to Maryland-based clients without first obtaining a reciprocal license, while consenting to the rules and disciplinary actions of the Maryland Board of Public Accountancy. Individuals and businesses in Maryland will now have access to a greater number of CPA firms to meet their specific needs without having to bear additional compliance costs.

The AICPA supported the Maryland Association of CPAs’ (MACPA) efforts to work with its legislature on this important initiative. CPA firm mobility reduces compliance burdens on CPA firms and removes barriers to practice. In today’s digital economy, it’s vital for CPAs and CPA firms to be able to offer services across state lines. Additionally, clients need to access specialized services that may not be provided in their state.

MACPA executive director and CEO Tom Hood commented, “We received tremendous grassroots support from our members on this effort and are excited to say the firm mobility bill passed unanimously.”

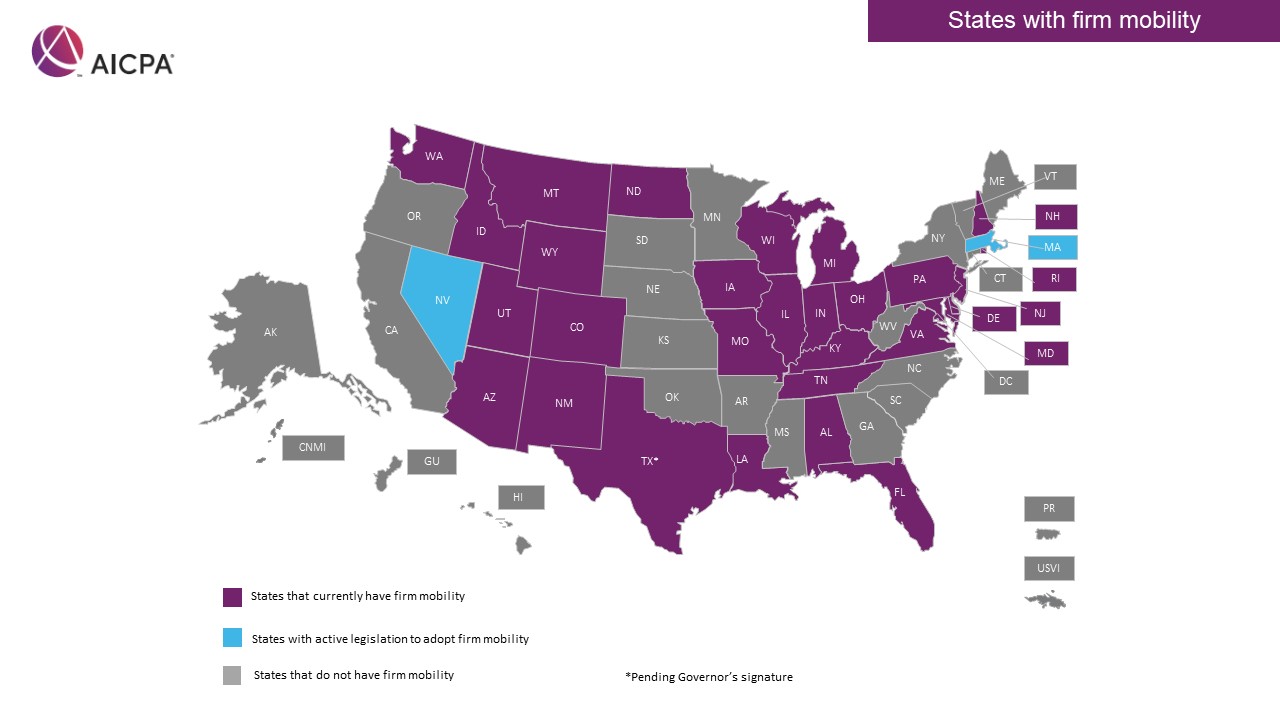

Governors in New Jersey and Wyoming also signed CPA firm mobility legislation this year. The Texas legislature passed firm mobility legislation and the bill is pending the Governor’s signature. The Nevada legislature is currently considering a firm mobility bill. If you are interested in working on CPA firm mobility legislation in your state, please reach out to your state CPA society.