Colorado adopts CPE reciprocity

August 7, 2019

Colorado Governor Jared Polis signed legislation into law earlier this summer to allow non-resident CPAs to meet Colorado’s CPE requirements as long as the CPAs meet the CPE requirements in their home states.

The CPA profession's successful individual mobility campaign allows many CPAs to hold one CPA license instead of multiple reciprocal licenses in various jurisdictions. However, in certain circumstances, a CPA may prefer to continue to hold more than one license.

For example, certain jurisdictions require a CPA to have an active in-state license if they are performing certain types of specialized attest work. Other CPAs may work near a state border and find it important to hold a license in the CPA's home state as well as in the state where the firm maintains a second office.

Given that CPAs may still hold multiple state licenses, CPE reciprocity provides a reasonable accommodation for multiple license holders' CPE requirements across state lines.

Under CPE reciprocity, all CPAs are required to obtain 120 hours of CPE every three years as a condition of licensure renewal. These hours must include four hours of ethics-specific training and not fewer than 20 hours of CPE in any given year. However, a CPA is exempt from meeting multiple jurisdictional CPA requirements as long as the licensee meets the CPE requirements of his or her home jurisdiction.

The AICPA supported the Colorado Society of CPAs’ (COCPA) efforts to work with its legislature on this important initiative. COCPA chief executive director Mary Medley commented, “ We worked closely with the AICPA’s State Regulation and Legislation team to develop draft language and provide context to the bill sponsors for why this was important to adopt, in the spirit of uniformity and consistency across licensing jurisdictions.”

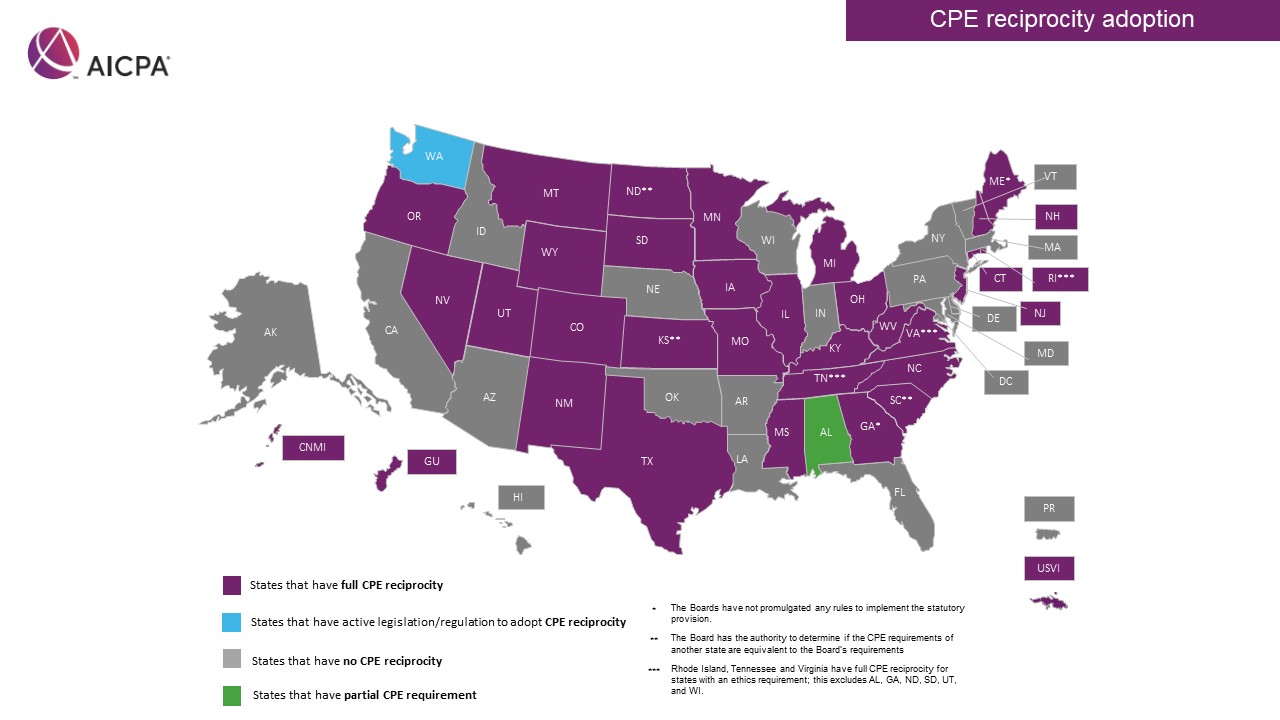

This rule is a logical and helpful exemption, ensuring CPAs are continuing their CPE while also avoiding complex multi-state compliance regimes. Thirty-two jurisdictions have adopted the provision so far. Washington's Board of Accountancy is working to adopt the provision through rules. If you are interested in working on CPE reciprocity legislation in your state, please reach out to your state CPA society.