AICPA briefs Capitol Hill staffers on changes resulting from Tax Cuts and Jobs Act

March 22, 2018

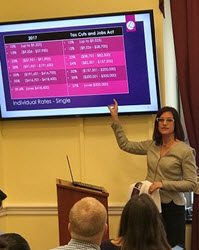

The American Institute of CPAs (AICPA) briefed Capitol Hill staffers on March 1 about what has changed and what stayed the same for individuals and businesses as a result of enactment of the tax reform legislation commonly referred to as the Tax Cuts and Jobs Act (TCJA).

Kristin Esposito, CPA, MST, and Amy Wang, CPA, senior managers on the AICPA Tax Policy and Advocacy Team, recapped the law’s provisions for U.S. Senate and U.S. House of Representatives staff to help them answer constituents’ questions about the current tax filing season.

The two explained the differences between the tax rates for individuals in 2017 and under the TCJA, the change to the standard deduction, the suspension of the current personal exemptions after 2017 until 2026, the changes for itemized deductions such as for medical expenses, state and local taxes, mortgage interest, charitable contributions, casualty losses and miscellaneous itemized deductions subject to two percent of adjusted gross income. They also covered changes to the child tax credit and non-child dependent credit, education tax benefits, alimony, the alternative minimum tax and the Affordable Care Act.

Esposito and Wang told the group that taxpayers should verify that their federal tax withholding is accurate by using the Form W-4 withholding calculator on the Internal Revenue Service (IRS) website. They emphasized that taxpayers should make the necessary adjustments to their Form W-4 in order to avoid being under-withheld, which could result in a penalty as well as a large tax bill. Taxpayers should also remember, they said, that over-withholding will result in a refund because too much money was withheld from their paychecks.

On the business front, they spoke about the law’s new corporate tax rate, changes to deductions for business meals and entertainment, commuting benefits and the interest deduction limit, as well as the new 20 percent deduction for qualified business income for eligible pass-through entities, the international provisions, the increased threshold for using the cash method of accounting, bonus depreciation and repeal of the domestic production activity deduction.

The Congressional staffers asked questions about many of the individual and business provisions and were also interested in the outlook for proposed regulations and interim notices from the U.S. Department of the Treasury and the IRS.

Esposito and Wang reminded the attendees that the AICPA’s staff is available as a resource and that the AICPA’s Tax Reform Resource Center is a valuable reference that offers the latest information about implementation of the TCJA.