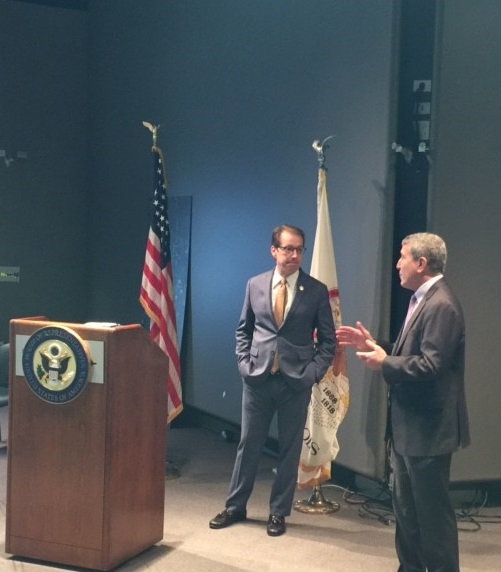

Illinois CPA Society Members Discuss Tax Reform with Rep. Roskam

Article and photo courtesy of the Illinois CPA Society

February 23, 2017

Illinois CPA Society members who live in the state's 6th Congressional District and who specialize in tax had a unique opportunity to participate in a tax roundtable discussion with Congressman Peter Roskam on February 9 in West Chicago, Ill. Roskam, who serves as the chair of the U.S. House of Representatives Ways and Means Committee Tax Policy Subcommittee, hosted the event along with the Illinois CPA Society (ICPAS) which has worked closely with Congressman Roskam and his staff over the years.

Congressman Roskam provided the CPA gathering with a briefing on the political state of play on tax reform and then solicited suggestions from panelists on reform areas. Congressman Roskam and House Republicans have identified overarching principles of a new tax code that would be pro-growth, simple, and would encourage and facilitate competitiveness. Tax reform would have to be revenue neutral.

Participants provided Congressman Roskam with feedback on areas such as a simplistic definition of business income, the difference between accrual and cash basis accounting, and how businesses use these accounting methods for tax purposes.

“This was an excellent opportunity for our members and Congressman Roskam’s constituents to provide him answers and feedback on tax reform issues,” said Todd Shapiro, ICPAS President and CEO.

The Illinois CPA Society Government Relations Office put together the diverse panel at the request of the Congressman’s Office. “We were happy to facilitate this discussion as a part of our ongoing relationship with Congressman Roskam,” said Martin Green, ICPAS Vice President of Government Relations.